Businesses invest a lot in numerous customer acquisition and retention strategies to gain fresh customers and see stable financial growth.

However, customer acquisition vs customer retention – which one is more important? This question is unjustifiable, as both are equally important to the growth and viability of an enterprise.

Moreover, many companies spend more time and resources acquiring customers and are unaware of the retention part. Retention provides a better ROI for certain businesses and is profitable.

What marketing features should companies focus on? Let’s discuss them in detail.

What does customer acquisition mean?

Customer acquisition is how you promote your business, and design conversion experiences to compel prospective customers to purchase a product/service or download an application.

This process can involve many ways that the prospective customer passes from being completely unaware of your product to choosing your product against your competitors to decide to buy.

What is the Purpose of Customer Acquisition?

The main objective behind getting new customers to any business is to increase more sales, which in turn enhances the ROI.

What are the Three Parts of Customer Acquisition?

A successful customer acquisition strategy consists of three following parts:

- Magnetize leads

- Nurture those leads until they become sales-oriented

- Convert nurtured leads into customers

SEMRush’s general statistics show that online display advertising is the most effective platform for acquiring new customers, yet only 4% of marketing professionals use it for customer retention.

Apply customer segmentation to acquire new customers

What are the Advantages of Acquisition?

Businesses can expect the following benefits from customer acquisition services:

Grow your business: If your business gets new clients, it can develop fresh products based on their suggestions.

It is because they compare your product with competitors, and come with important information that will reshape your business.

Expand your business: What will you do if you get multiple new clients at once?

You’re growing your business, aren’t you? That’s one of the major advantages of acquisition. Once the company grows, there’s going to be an increase in sales and profits.

It helps in maintaining a business: Sometimes, businesses don’t retain their clients.

In such cases, they end up making profits and start seeing a downfall. To overcome these situations, businesses must start looking for new clients and try to retain the present ones. That’s going to keep them in the marketplace.

The major drawback of acquisition is, it has a very short life span.

What are the Top Challenges to Great Customer Acquisition?

Marketers face the following challenges in creating a great acquisition campaign.

- Grabbing customer’s attention

- Creating the first impression with their customers

- Customer acquisition and GDPR

- The increasing cost of CAQ

Why is CAC Important?

CAC (Customer Acquisition Cost) is a very important metric to evaluate the effectiveness of your marketing campaign or customer acquisition strategy.

It acts as a key metric for potential customers, helping them to measure the growth of your business.

However, you need to understand that focusing too much on reducing CPA can be dangerous as Lifetime Value (LTV) also plays a major role in increasing efficiency.

In short, CAC is the money that a business invests in acquiring new clients.

The formula for CAC is complete sales and marketing investment over a specific time divided by the number of fresh customers over that same time.

The total CAC involves numerous components:

- your marketing costs

- the cost of your tools

- Your sales costs

- technical costs

- Inventory, and creative costs

Reducing your customer acquisition cost indicates you earn enough from each transaction, enhancing both your profit margin and ROI.

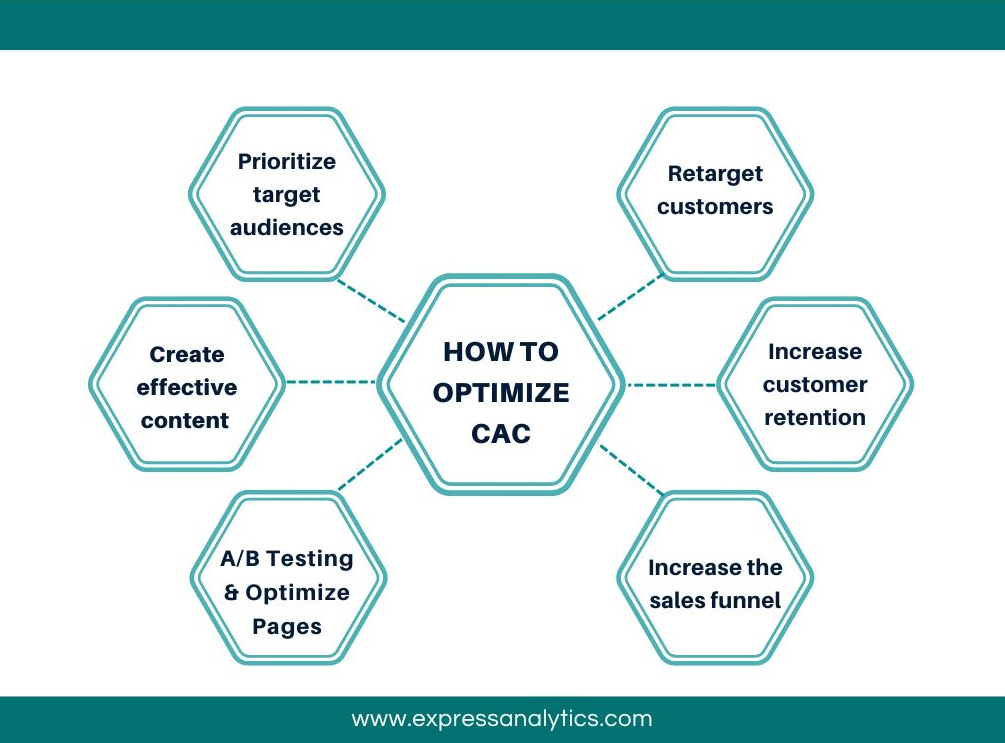

So, listed below are some simple strategies you could implement if you want to lower your customer acquisition costs.

- Prioritize niche/target audiences

- Retarget customers

- Increase customer retention

- Create effective content to offer value-added information to customers

- A/B testing and optimizing landing pages

- Increase the sales funnel

What is Meant by Customer Lifetime Value (LTV)?

LTV is generally the revenue you generate from any given client over some period.

LTV can be difficult to understand in a young business where there is no large quantity of historical data, but it is definitely a major element you can use to improve the effectiveness of your business decision-making.

How Do You Calculate Customer LTV?

There are several techniques to calculate LTV. It involves measuring how long an individual client is expected to continue with your business, and how much revenue he/she will contribute over his subscription.

A very simple method to calculate LTV is to multiply the average revenue a client generates over a month/quarter by the average duration of the contract.

Once you have got the CAC and LTV, you can easily calculate the ratio. For this, you must divide the LTV by the CAC.

A 3:1 LTV/CAC ratio is a good target, which defines you should make 3 times more of what you would invest in acquiring clients.

LTV/CAC ratio of less than 3 indicates marketing expenses are high, and the focus should be on reducing expenses.

How to Improve LTV/CAC Ratio?

You should remember the following points to improve LTV: CAC ratio:

- Concentrate on the appropriate channels

- Experiment with your pricing

- Set up the tight sales funnel

Why is there a Greater Emphasis on Acquisition than on Retention?

That’s because, without any customers, it’s difficult to imagine the existence of any company. To set up any business, it is necessary to get at least a few customers.

This continuous process helps organizations increase their customer base and get more business opportunities.

Companies spend a lot of money to acquire customers because they think it is a powerful option for increasing revenue.

What Does Customer Retention Mean?

Customer retention or client retention is an activity and action businesses take to minimize the count of customer defections.

It is very important to understand that this process starts with a customer’s initial contact with the company, and maintains throughout the entire cycle of the relationship.

What are the Major Benefits of Customer Retention?

Customer retention is a faster process and costs up to 6 times less than acquisition.

Selling your product to customers with whom you have a strong relationship is the best way to increase revenue because you can avoid the losing time and money required to attract, educate, and convert new customers.

It is a far better process because here potential customers will get more knowledge, and practices required to improve the value they get from your product.

People who visit your website for the first time will also be in the awareness path of the marketing funnel.

They spend some time visiting other websites, comparing prices, and looking at the reviews before making decisions.

Whereas, your present customers are not required to go through all these stages, and know how perfect you are. In short, this activity will increase customer lifetime value (CLV).

Use behavioral modeling to acquire new customers

What are Some Customer Retention Strategies?

Feedback collection and listening to customers: Conduct a survey to collect feedback from your customers about your brand.

Do you need to find out whether your product was able to meet their expectations? Was it expensive? Ask, listen, and improve.

Provide offers: You can customize offers for your customers only if you know them better. Understand their behaviors, their interests, and see their purchase history.

Launch customer loyalty programs: Loyalty programs including free upgrades, special offers, and access to unreleased samples will encourage them to stay with your brand.

Where Do You Need to Spend More Money: on Acquisition or Retention?

Almost all companies have limitations on what they spend on their marketing activities. So, it’s crucial to know which part leads to success – customer acquisition or customer retention.

Here are some common factors to keep in mind before making this decision:

The acquisition is expensive: Statistics aren’t the same for all industries, but research proved that acquisition is more expensive than retention.

When it comes to getting new clients, you are starting from the beginning. They likely don’t have any experience with your product and may think twice before trusting your company.

It requires time, and money to attract them, and convince them to buy a product from you.

With existing customers, you don’t need to deal with such challenges.

Therefore, this is the best response to the question “why customer retention is cheaper than customer acquisition?”

Retention yields better ROI: According to the research, businesses may achieve a profit of up to 95% if there is a 5% growth in retention rates.

Increases word-of-mouth publicity: When you deliver quality service to your existing customers, and if they are satisfied with your service, they can refer your company to others.

Thus, retention nourishes your acquisition, and it doesn’t require a single coin for such publicity.

What are the Similarities of Customer Retention and Acquisition

Customer acquisition and retention primarily focus on many things; they have similar working principles in terms of what they want to achieve.

The ultimate goal of both strategies is to create a powerful customer experience and generate revenue for companies.

Let’s have a closer look at the major similarities between the two strategies:

- A business cannot run without customer acquisition, whereas it becomes unstable without retention. Acquisition ensures business growth by opening the door to opportunities and increasing the customer base, but retention is responsible for producing predictable, regular income.

- Customer retention is all about careful planning related to reaching out to prospects and converting them into hot leads. This requires a better understanding of the market, a unique selling proposition, and capitalizing on solving customer problems. On the other hand, customer retention is all about preparing a strong strategy for understanding customers, their problems, and how long you serve them better. This involves analyzing what led them to visit your site and what products you want to show them, etc.

- Customer acquisition yields better results when brands are in touch with clients through their guarantees, services, and products, while brands can retain clients by living up to the promises made by them in the past.

Conclusion:

Coming back to the question: customer acquisition or customer retention? The key answer to this question is purely dependent on the stage your business is in. If yours is a brand-new business, improving brand awareness through customer acquisition is obviously your high priority. Whereas, if your business is well-established, the chances of losing valuable sales could be more by not investing heavily in retention activities that help to grow customer loyalty.

Build sentiment analysis models with Oyster

Whatever be your business, you can leverage Express Analytics’ customer data platform Oyster to analyze your customer feedback. To know how to take that first step in the process, press on the tab below.

Liked This Article?

Gain more insights, case studies, information on our product, customer data platform