Benefits of Automatic Data Extraction in Finance

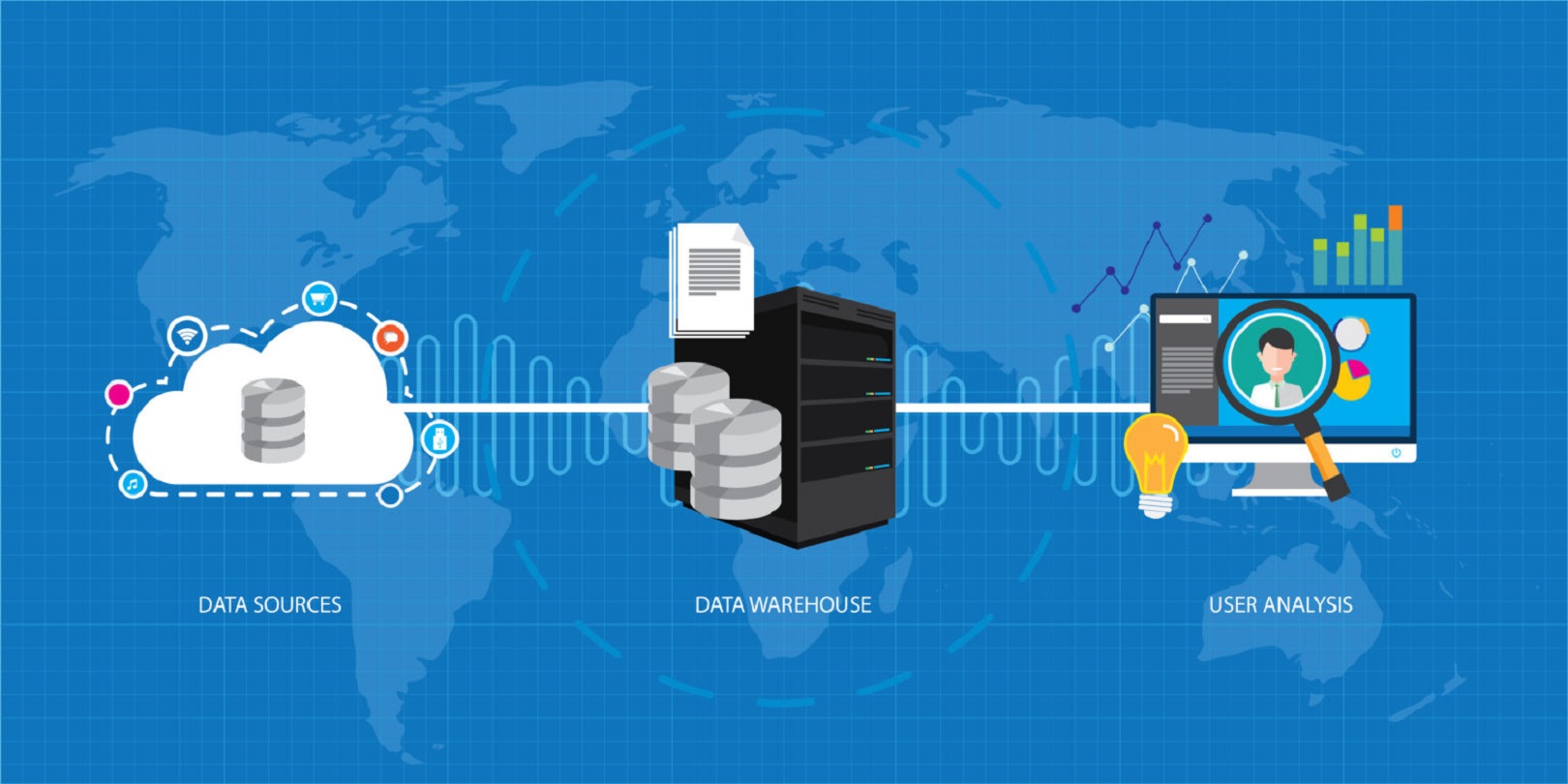

Benefits Of Automatic Data Extraction In Finance In part 1 of the blog, we read about what is data ingestion and why it is necessary for financial institutions to automate this, Inn this blog we will look at Benefits Of Automatic Data Extraction In Finance. Be it the approval of loans or predicting future trends,… Continue reading Benefits of Automatic Data Extraction in Finance

Automatic Data Ingestion in Finance

Automatic Data Ingestion in Finance There’s no doubt that automation is changing, for the better, business performances in finance. Automating data extraction and ingestion adds value to finance departments and institutions. A recent survey by Dun & Bradstreet of finance operations in the US and the UK showed that improved speed of processes was the leading motivator for… Continue reading Automatic Data Ingestion in Finance