Customer churn is the most serious challenge businesses encounter today. Losing customers affects both revenue and increases acquisition costs. With our churn prediction model, you can actively identify possible churners before they leave and use focused strategies to retain them.

Churn Prediction Model :

Retain Your Customers with Accuracy

Struggling to retain your customers?

The churn prediction and prevention model is the latest data-based solution designed to inspect customer engagement rates, behavior, transaction details, and more. Identifying trends and symptoms that point out possible churn, allows companies to make the right decisions to hold customers and increase lifetime value.

How Does the Customer Churn Prediction Model Affect Your Businesses?

Churn can affect several regions of a business, such as:

Increase your sales through your customers

Learn how Express Analytics can help you reduce churn

Major metrics to predict customer churn

Businesses can use the following metrics for churn prediction using machine learning:

- Customers that departed :

This will be the focus column in the ML model to foresee churn. - Services used by customers :

This identifies the subscription plans or services the customers used and signed up for. Several subscription features and tiers specify the customers’ preferences. - Information about a customer’s account :

This dataset involves information regarding a customer’s preferred payment option, billing, how long they are staying with a company, monthly charges, and past transactions. It also contains account names, contact information, and billing addresses.

Essential Features of Our Churn Prediction Model

How can Express Analytics help you in Customer Churn Prediction and Prevention?

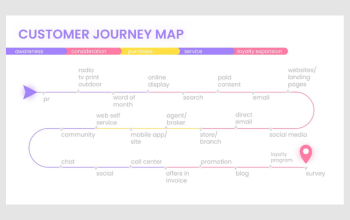

Express Analytics’ ML platform lets you predict customer churn models before they occur. Our platform uses modern ML algorithms to examine retail data and find trends that point out possible churn. Our platform can provide a holistic view of every customer’s behavior by analyzing several data points, including website visits, social media activity, customer service touchpoints, and purchase history.

Our best model for churn prediction can answer the following questions to determine whether a customer is likely to leave:

- How long has the customer been with your business?

- How regularly do they buy services/products from the business?

- How much do they usually spend? What is the age and place of origin of an average buyer?

- Do they have any sort of loyalty program or membership?

Let’s Connect –

Industry-specific Applications

eCommerce :

Find unengaged shoppers and re-engage them with customized offers

Retailer :

Increase loyalty by keeping your best spenders engaged.

Financial services :

Track customer behavior across credit products, and loans

Restaurants :

Offer routine menu updates to keep customers engaged

Reports that can be created through Churn Prediction and Prevention Model

| Report Name | Description | Example |

| Churn Probability Report | Lists customers along with their predicted churn probabilities and actions needed. | Customer ID : 1001, Probability : 0.15, Action: Maintain Engagement |

| Churn Rate Summary | Summary of the overall churn rate within a specific time frame. |

Total Customers : 1,000, Churned: 150, Churn Rate: 15% |

| Customer Segmentation Report | Segmentation of customers based on churn risk, allowing targeted strategies. | Segments : High Risk (30%), Medium Risk (20%), Low Risk (50%) |

| Action Plan Report | Detailed plan of actions to be taken for high-risk customers. | Actions for High-Risk : Discounts, Improved Support. |

| Feedback Analysis Report | Analysis of customer feedback scores correlated with churn predictions. | Average Feedback Score for Churned Customers : 2.5 |

| Retention Campaign Effectiveness Report | Evaluates the success of retention campaigns based on churn predictions. | Campaign: Discount Offer, Churn Reduction : 20% |

| Trend Analysis Report | Trends in customer churn over time, visualizing increases or decreases. | Churn Rate Trend : Jan 2023 (12%), Apr 2023 (15%), Jul 2023 (18%) |

What Questions Does the Churn Prediction Model Resolve for Clients?

- Who are the customers at risk of churning?

- What factors contribute to customer churn?

- How can we retain at-risk customers?

- What is our overall churn rate?

- How does churn rate vary by customer segment?

- What is the financial impact of churn?

- How effective are our retention strategies?

- How can we improve customer satisfaction?

To get answers to these questions, fill out this contact form.

- Who are the customers at risk of churning?

Identifies customers with a high likelihood of leaving the service or product.

Example : Customer ID: 1001, Probability of Churn: 0.75 - What factors contribute to customer churn?

Analyzes data to pinpoint key reasons why customers decide to leave.

Example : Factors: Low customer service ratings, pricing issues - How can we retain at-risk customers?

Provides actionable strategies to engage and retain customers who are predicted to churn.

Example : Suggested Action: Offer a loyalty discount - What is our overall churn rate?

Calculates the percentage of customers that have churned within a specific timeframe.

Example : Churn Rate: 15% in Q2 2023 - How does churn rate vary by customer segment?

Examines churn rates across different customer demographics or behaviors to identify patterns.

Example : High churn in Segment A (20%) vs. Segment B (10%) - What is the financial impact of churn?

Estimates the revenue loss due to customer churn over a specified period.

Example : Projected Revenue Loss: $150,000 for Q2 2023 - How effective are our retention strategies?

Evaluates the success of current initiatives aimed at reducing churn.

Example : Retention Strategy Success: 10% reduction in churn after discounts - How can we improve customer satisfaction?

Identifies areas for improvement based on churn predictions and customer feedback analysis.

Example : Recommended Improvement: Enhance customer support training.